Bonds: Simplified

Professional bond analytics, redesigned.

Questions?

Completely Redesigned Experience

- Beautiful, modern interface built with Apple’s latest design principles

- Intuitive navigation with enhanced visual clarity

- Streamlined workflows that make complex calculations accessible

- All your favorite features improved and easier to use

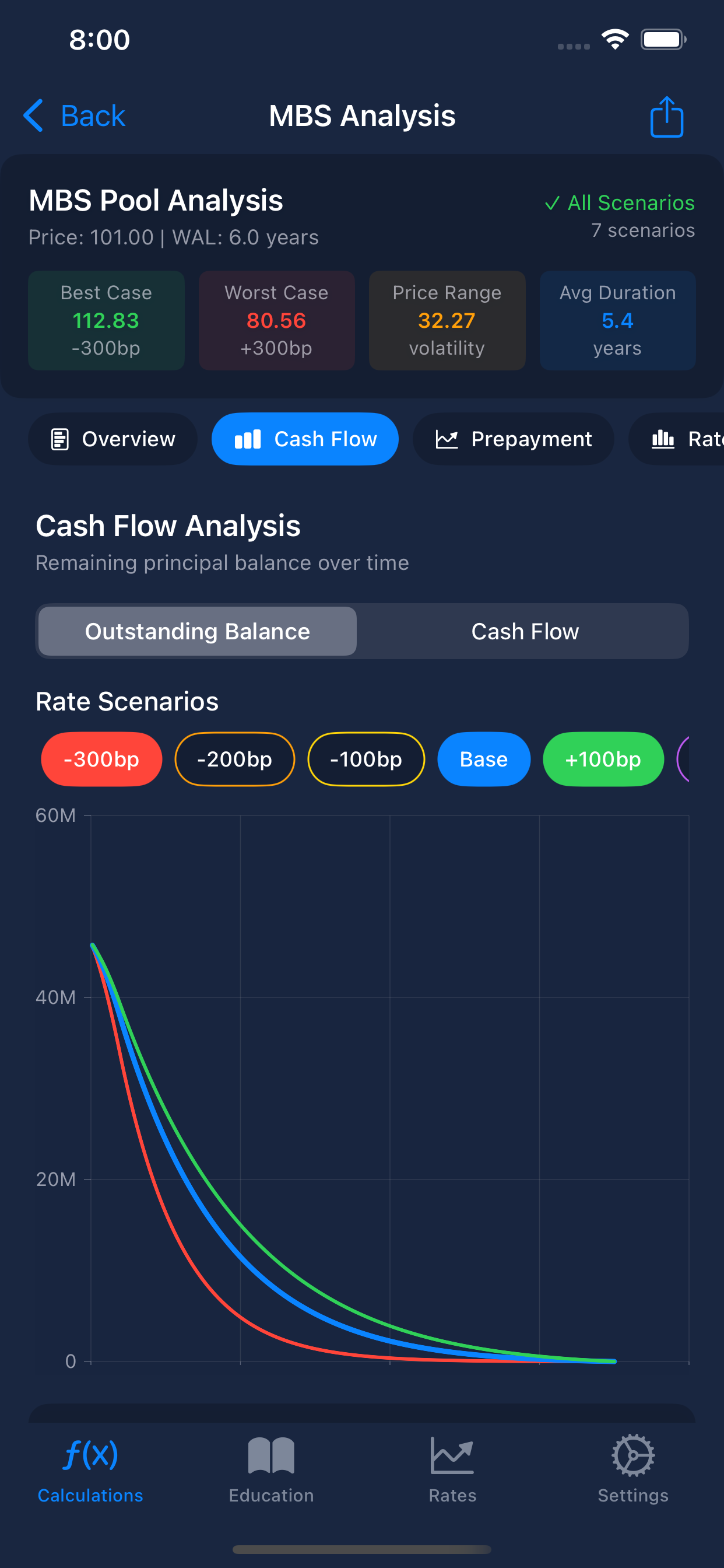

Advanced MBS Analytics

- Comprehensive MBS parameter configuration with instant yield calculations

- Input pricing and see spreads and key performance metrics

- Side‑by‑side prepayment sensitivity tables supporting both PSA and CPR methodologies

- Prepayment modeling with sensitivity from −300 to +300 bps

- Dynamic rate shock analysis comparing baseline speeds across rate environments

- Horizon yield curve interpolation with customizable time horizons and rate moves

- Rich charts for periodic balances and projected income streams

- Detailed amortization schedules with scheduled & unscheduled principal and CPR

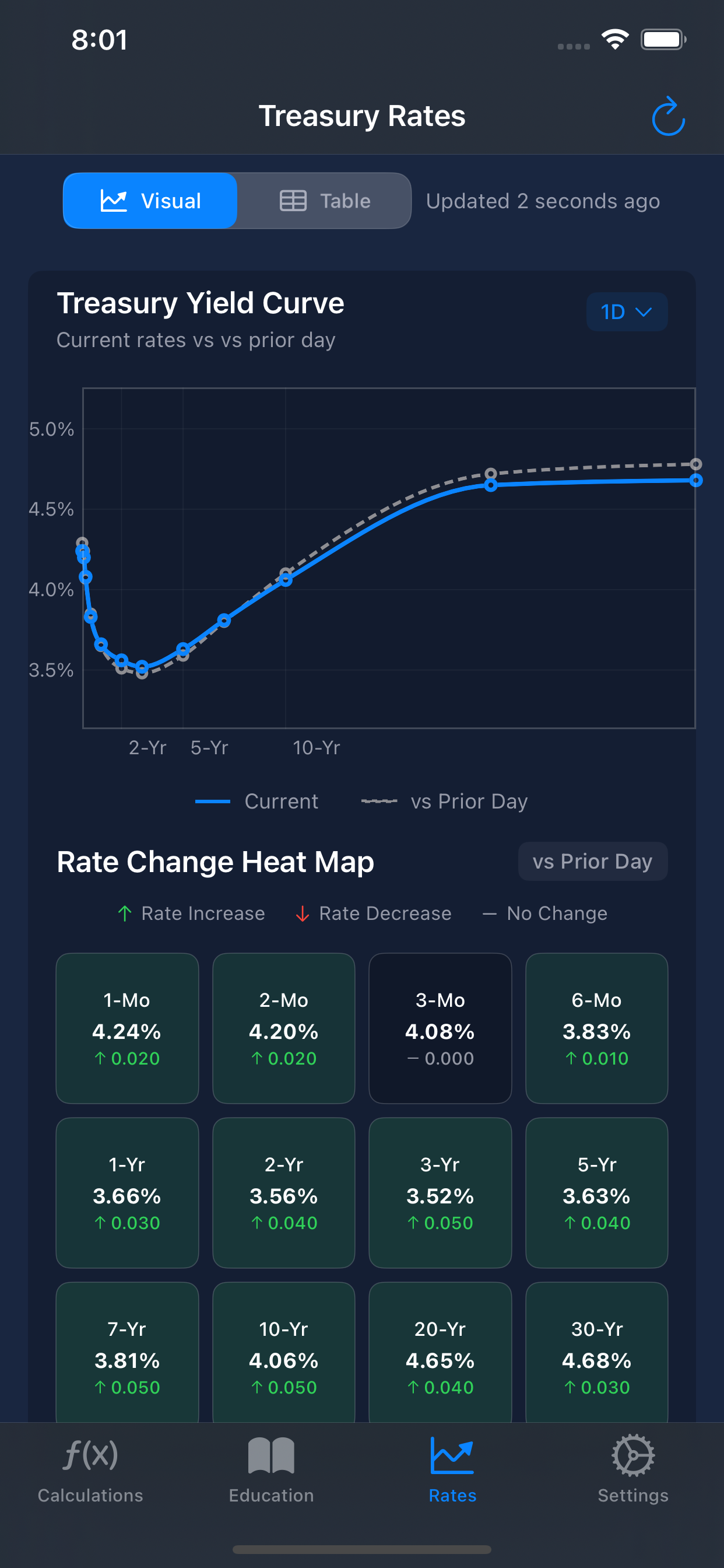

Accessible Market Data

- Pull US Treasury yield curve updates via modern API for accurate spread analysis

- Seamless integration of current market rates into your calculations

- Historical rate tracking for trend analysis

- Change heat map over dynamic dates

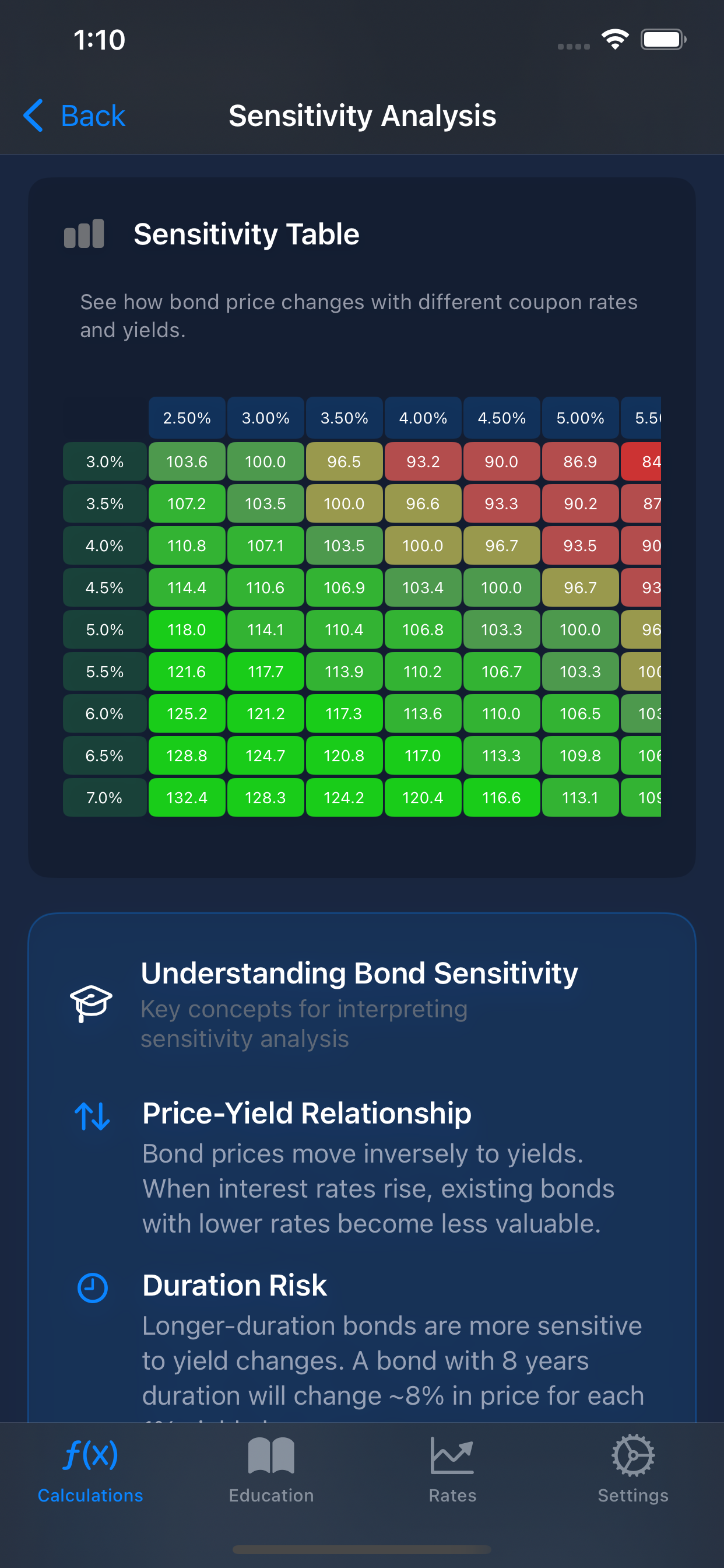

Comprehensive Bond Tools

- Fixed‑rate bullet bond calculator for traditional bond analysis

- Multi‑scenario comparison capabilities

- Stress testing across various rate environments

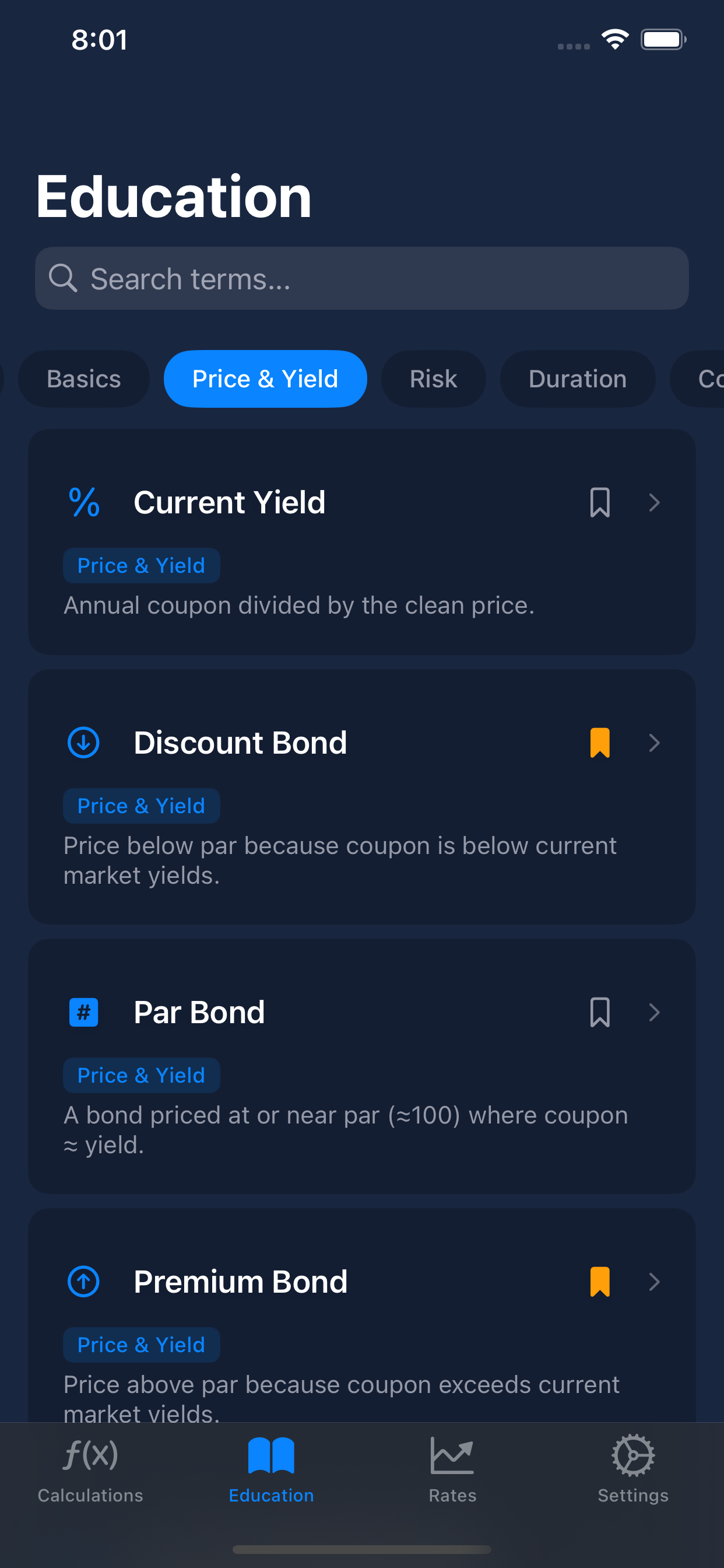

Educational Resources

Understand the mechanics behind fixed income valuation. Bonds: Simplified performs the calculations and explains the underlying assumptions and methodologies—helping you become a more informed analyst.

Important: All calculations and valuations are estimates for analytical purposes and should not be relied upon for actual investment transactions. Please consult with qualified financial professionals for investment decisions.